Look, I get it. You’re not a psychic.

But you can still plan for things you know are going to happen. This includes vacations, car maintenance, houses, weddings, kids, whatever.

Before you learn how to start investing, learn how to save for your future.

The trick to saving is to start WAY BEFORE you actually feel like you need to.

Remember, things are always closer than they appear and the sooner you start the easier it will be.

I don’t care if you don’t have a boyfriend, if you want an elaborate wedding, start saving NOW! Lol

This same logic applies to cars, kids, investment properties, etc.

And don’t fall into the trap of waiting for things to get better before you start saving.

As things get closer, chances are you’re going to feel like things are getting worse.

That’s just life.

Trust me on this. Find a way to save something (it doesn’t have to be much) as soon as possible.

If you want to save for specific things without opening multiple accounts, I have just the thing for you.

It took me months to find tools that work exactly how I want them too, but I did. For this, I recommend:

1. Smarty Pig for people who like to keep things fun and simple. (Web based)

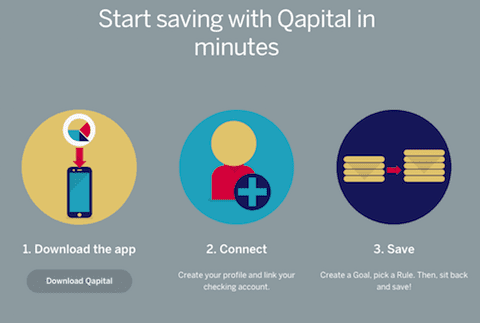

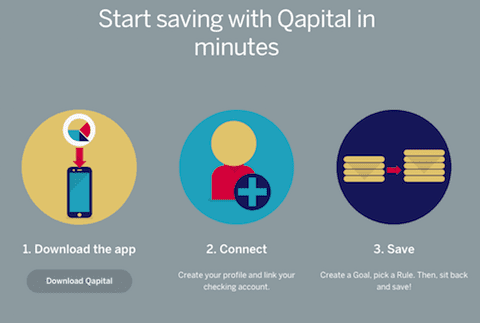

2. Qapital for people who want lots of features and sleek design. (app based)

Obviously, both are very safe to use and will help you easily save for the things that are important to you. I love them both so much but because Qapital has more features (it’s an app!) I tend to use that more!

When you have money put away for things that are coming up, you can invest with confidence instead of fear of what may happe

It’s one thing to have a budget, but it’s another thing ENTIRELY to make it come to life.

It’s one thing to have a budget, but it’s another thing ENTIRELY to make it come to life.  For most people, that’s where the disconnect is. Not the budget itself.

For most people, that’s where the disconnect is. Not the budget itself.  Our Beyond the Budget Blueprint is specifically designed to help you fall in love with your budget and bring your goals to life.

Our Beyond the Budget Blueprint is specifically designed to help you fall in love with your budget and bring your goals to life.  $27, right now! Normally $197.

$27, right now! Normally $197.