How to Hit Your G-SWOT

And Complete Your End-of-Year Financial Review Without Guilt or Shame

When was the last time you actually did any type of performance review? For yourself!?

If it’s been awhile, I understand why.

For women who’ve experienced the vibe of corporate America, especially Black women, performance reviews can be a real buzz kill.

In an environment that is often dominated by patriarchy, we rarely have the opportunity to get honest and objective feedback that’s not steeped in racism or misogyny.

The odds are stacked against us and we rarely feel safe enough to use our own voice.

But what if I told you that a performance review could make you feel pleasure in ways you never have before?

We call it hitting your G-SWOT and it’s a financial framework to help you decide whether you’ve been naughty or nice… to yourself and your future.

For high achievers like you, self-evaluation gives you a competitive advantage over people who are just winging it day to day and year to year.

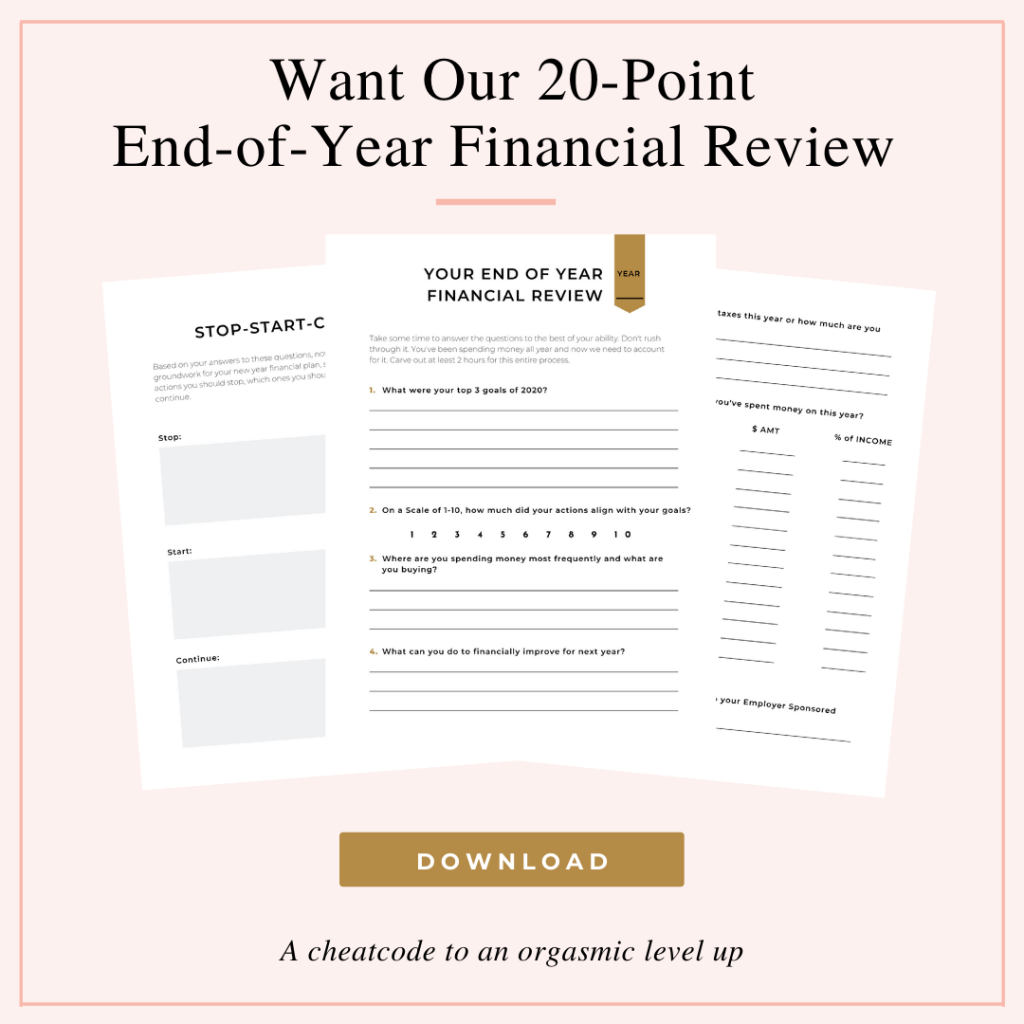

You can think of it as a cheat code to an orgasmic level up because to be honest, the right review process will change your whole life…

And when you don’t review, guess what happens?

You end up financially frustrated.

Or more specifically, you realize the end of yet another year has come and gone, but you’re still unsatisfied… dealing with:

- an excruciating anxiety around money

- balancing must-have’s with the magnetic pull of instantly gratifying purchases

- what it really means to “adult” and support yourself

Today, we’re going to show you how to hit your G-SWOT with laser precision as we walk through a simple evaluation of this year’s financial journey, so your numbers get sorted without the overwhelm or the mental shutdown.

And while you can technically use this framework to review any area of your life, we’re going to use it to dive deeply into your financial performance.

Hitting Your G-SWOT (Without the Guilt or Shame)

There are 5 elements of our G-SWOT process, each one designed to give you a high level overview that lends itself to future planning and future pleasure.

The acronym itself starts off with a G, which stands for goals.

The SWOT part is a little something I picked up from Albert Humphry at the Stanford Research Institute in the 1960s.

The acronym stands for Strengths, Weaknesses, Opportunities, and Threats.

“SWOT analysis is a planning methodology that helps organizations build a strategic plan to meet goals and improve operations.”

We’re gonna use it to do a high level evaluation of your finances.

Let’s jump in!

Element 1: The Go-Getter's Holy Grail

it is pretty undeniable that goal setting is the go-getters holy grail. And I know exactly why.

The goals you set for the year create the foundation of everything you do and are obviously the barometer by which you measure your success.

If you’re like me, goal setting is what you do. Every year, every month and every week you’re focused on taking your life to the next level.

The weapons of my warfare include notebooks, journals, pretty pens, printables, binders and more. On the battlefield that is life, my goals give me the ammunition I need to conquer my competition. Which is usually myself.

I’m competing with my past performance and doing everything I can to become the woman I’m destined to be.

So ask yourself:

What were your top 3 goals for 2020?

Overall, did your actions align with the goals you set?

What are the top 5 things that you spent your money on and how much?

Where are you spending most frequently and what are you buying?

What can you improve to reach beyond your current level?

Equipped with these answers, you have an abundance of information to help you attack the new year.

Element 2: Strength, Where Do You Shine

So when we talk about your financial strengths consider whatever you’ve accomplished and the results you’ve produced.

For example, my financial strengths of the year include:

- Saving consistently by setting up automations.

- Positively shifting my money mindset by using journals.

- Significantly increased net worth by using net worth tracker weekly instead of monthly.

Your strengths should clearly demonstrate that you’ve been taking action and seeing the fruit of your labor. Whatever shows up here, make sure you keep it going.

So ask yourself, What were your greatest financial strengths of the year?

Element 3: Weakness, Where Do You Struggle?

Take courage my sweet and relax.

We’ve hit the part of the evaluation most of us would rather excuse ourselves from.

I know I said you’d experience some of your wildest pleasures during this process, but you have to go along for the ride.

In this context, it’s not about making it easier on your financial ego and pride. It’s about looking at things you may not want to see so that you can come back stronger, better, and more ravenous than ever.

So —

Consider this year’s points of weakness as the EXACT things you know to “avoid” for next year if a smoother, more profit-oriented outcome is your goal.

My biggest weakness this year was dining out far too much (Thanks Rona!!) and a higher income definitely meant letting more money slip through my fingers.

Here are some questions to ask yourself:

What holds you back from financial advancement?

Did you notice any routine activities that have a negative effect on you or your bank account?

What financial mindsets are keeping you stuck?

Can you think of one critical task in particular you need extra help with?

Element 4: Opportunities, What Are The Possibilities?

This isn’t the time to paint unreal fantasies or waste energy on what doesn’t align with who you are or where you’re at.

But at the same time, don’t limit yourself to doing what you’ve been doing.

Push yourself beyond your comfort zone and do what it takes to deliver.

Think of any skills, knowledge, passions, experiences, etc., that could give you a real advantage over your current circumstances and situation.

This might include a training you took, a project you worked on, people in your network, etc. Sometimes we don’t even acknowledge the weight of who we are, what we’ve done, or who we know. How can use these things to create more financial opportunities?

Now through this lens, ask yourself:

What opportunities can you use to advance?

Which activities give you energy to excel?

Element 5: Threats, What's In Your Way

For every goal that you have, there’s something that can get in the way of it becoming a reality.

Right now, your job is to figure out what those things are (or have been!) so that you have a fighting chance of doing better this year.

Financial threats could include anything from bad habits to bad mindsets, so be honest with yourself about what could trip you up on your journey to financial freedom.

Ask yourself…

What hidden (in plain sight) factors stop you from hitting your financial goals and making the necessary changes that would allow you to do so?

Congratulations, you completed the review process!

It’s this kind of clarity, coupled with consistency, that transforms your tedious and tiresome adulting juggle into the experience of financial bliss you crave.

It’s one thing to work hard for moment of ecstasy that lasts only for a minute, but this process sets the tone for something more.

It’s the difference between lust and love.

THIS is the type of financial freedom that could last a lifetime… and for generations to come.

It’s one thing to have a budget, but it’s another thing ENTIRELY to make it come to life.

It’s one thing to have a budget, but it’s another thing ENTIRELY to make it come to life.  For most people, that’s where the disconnect is. Not the budget itself.

For most people, that’s where the disconnect is. Not the budget itself.  Our Beyond the Budget Blueprint is specifically designed to help you fall in love with your budget and bring your goals to life.

Our Beyond the Budget Blueprint is specifically designed to help you fall in love with your budget and bring your goals to life.  $27, right now! Normally $197.

$27, right now! Normally $197.