3 Steps to Save Your Way to a Quick $1K

The Planner’s Guide to Building Wealth

Do you LOVE planners, notebooks, checklists, and anything that will help you write down your dreams and make them a reality?

Because personally, I’m OBSESSED.

I can’t walk into a store without looking at planners, notebooks and other beautiful stationery. They’re my weapons of choice when it comes to not only taking control of my life, but also taking control of my finances!

Now, I’m sure my planner addicts know how to use a planner to manage aspects of day to day life. But how often do you use it to plan out your money?

Most people haven’t fully embraced financial planners.

I may see a few stickers here and there or even a budget insert, but I rarely see a well thought out financial planning system.

As a financial coach and someone who absolutely loves planning, I obviously had to do something about that.

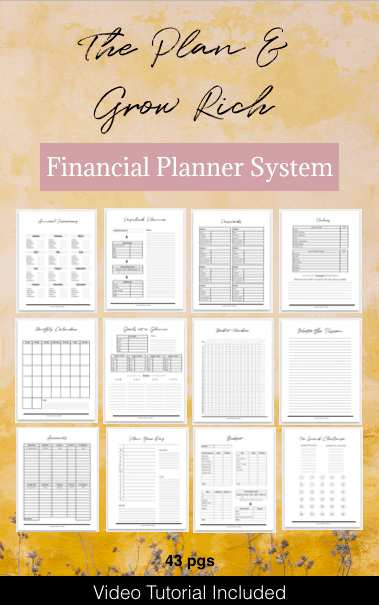

So, in addition to my everyday financial stationery, I created a financial planner system called “Plan & Grow Rich”. It addresses every single area of your finances in an easy and beautiful way.

So, whether you’re a boss chick with a Type A personality or a flourishing creative soul, financial planners are literally everything you need to create the future you deserve.

In fact, I’d go so far as to say that every woman should have one in her personal success arsenal.

In this article I’m going to walk you through how I saved my way to my first $1K and beyond.

How I Started Planning My Money

I created my very first financial planner out of a $1 composition notebook when I was 10.

I was living in one of the poorest neighborhoods in Chicago but deep down I knew I wanted something different.

Every single penny I made or spent was written down in my notebook.

When my dad gave me an allowance, I wrote it down.

When I spent a quarter at the candy store, I wrote it down.

I became meticulous about keeping track of how much money was coming in and how much money was going out.

Soon… I became the richest person in my house and the first person to open a bank account. By the time I went to college, I had thousands of dollars saved and made my very first investment soon after.

I learned many valuable lessons being a young girl from a poor neighborhood who was passionate about money. Here are the one’s I’ll never forget.

- It’s not about how much money you have. It’s what you do with it.

- Whatever you focus on is exactly what is going to flourish.

- Every sum of money starts with a single penny.

Planning with a Purpose

Planning and purpose were not words I heard very much as a child. My mom seemed allergic to planning and my dad wasn’t concerned about purpose. No one had taught them about that.

But I read enough books to know I wanted something different and I used planning as a way to get me there.

The very first part of creating a solid financial plan is getting grounded in your purpose so that you can meaningfully put every dollar to work.

In the Plan and Grow Rich Financial Planner you do this by writing out your vision and clearly prioritizing your values.

When you write down your vision, your goals come alive. They go from being something that exists in your head, to a concept that is now out in the world.

Writing out your values is the first step toward manifesting your desires and it also helps you realize what matters most.

When it comes to money, you only have a finite amount with an endless amount of things you want to do with it. So you have to be thoughtful about how you spend it.

Most people don’t plan much at all. Money comes, money goes, and then they wonder where it went.

As a matter of fact, when you think about how much money you made last year, do you know where it all went? How much ended up in your bank account? Hmmm.

This is one of the primary reasons people use our financial planner. Because they’re tired of wasting their hard earned money and they’re finally ready to make their money work for them.

When you take the time to plan out how you want to use your money before hand, magic happens.

I regularly have clients who start saving a thousand dollars every month when they never thought they had money to do so.

It blows me away .

If you could use even a fraction of that in your bank account every month, don’t hesitate to check out our printable financial planner system by clicking below.

Taking The Right Actions

When it comes to your finances, it seems like there are so many different things that you could be focused on.

But to be honest, that’s not productive at all.

Instead of trying to learn every little detail about money management, focus your efforts on the actions that matter the most.

Our entire financial system follows the natural flow of your money.

First, money comes in through a job or some other income source. Then, money goes out to pay for bills and other necessities. Lastly, the money that’s left over usually slips through the cracks.

The ultimate goal is simple: In addition to basic survival, you want to have money left over so that you can do more of the things you love and intentionally create the future you desire.

Here are the questions you should be asking:

- How can I increase my income?

- How can I decrease my spending? Where can I cut down or cut back?

- How can I use the money that’s left after spending to enjoy life and create the future I want.

The first two questions are designed to help you increase your uncommitted income. If you use our planner system you know uncommitted income is how much money you have left over after all spending is done.

So the million dollar question is number three: What do you do with the money that is left over so it doesn’t slip through the cracks?

How you allocate your money is up to you of course, but my clients focus on 5 action areas:

- Enhancing your life

- Building your emergency fund

- Saving for future wants and needs

- Investing for growth in the stock and real estate markets

- Paying down high interest debt and building good credit

These actions should be your very first focus when it comes to taking the right financial actions that will create a solid financial foundation.

These five things will take you very far. And using our financial planner system to stay focused and accomplish your goals will take you even farther.

Tracking Your Progress

Wow, if you’ve made it this far you’re really on to something. But there’s one more step left that can’t be ignored.

First, you created a purpose driven plan.

Second, you identified and began executing the actions that were going to help you make your plan a reality.

The final step is tracking your progress.

The truth is, you’re going to fall short. You’re going to skip some weeks. And you’ll feel horrible that you let yourself down.

But don’t be discouraged.

Your brain is not designed to stay focused on long term goals. It’s just not! To be honest, your brain is much more interested in instant gratification.

When you use our trackers to highlight your progress, not only do you hold yourself accountable to what you said you were going to do, but you create the conditions necessary to reach your long term goals.

You create the momentum needed to continuously push yourself in the right direction.

Because what I can promise you is that it isn’t going to just happen by itself.

In conclusion

I know many of us are already using planners, notebooks, and checklists to plan our lives. I hope that I’ve convinced you to consider using them to begin planning your money as well.

Our Plan & Grow Rich Financial Planner System is backed by years of financial expertise and psychology to work with you and your brain to achieve financial success.

So many people are watching their money slip away month after month, and year after year… but it doesn’t have to be like that.

I hope you’ll try out our planner printables. Make a small investment that is going to change how you save your money, once and for all

It’s one thing to have a budget, but it’s another thing ENTIRELY to make it come to life.

It’s one thing to have a budget, but it’s another thing ENTIRELY to make it come to life.  For most people, that’s where the disconnect is. Not the budget itself.

For most people, that’s where the disconnect is. Not the budget itself.  Our Beyond the Budget Blueprint is specifically designed to help you fall in love with your budget and bring your goals to life.

Our Beyond the Budget Blueprint is specifically designed to help you fall in love with your budget and bring your goals to life.  $27, right now! Normally $197.

$27, right now! Normally $197.